wyoming tax rate lookup

The Wyoming WY state sales tax rate is currently 4. Sweetwater County property taxes are available to search online.

Treasurer Hot Springs County Wyoming

This includes owner names mailing addresses.

. Use this search tool to look up sales tax rates for any location in Washington. Click the link below to access the Tax Bill Lookup. Doing Business in the State.

Use this search tool to look up sales tax rates for any location in Washington. The Wyoming sales tax rate is currently. The page will open in a new window.

Address Lookup for Jurisdictions and Sales Tax Rate. If you have any questions regarding these taxes please contact the Sweetwater County Treasurers office at 307 872. The Wyoming sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the WY state sales tax.

Back to Excise Tax Division. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000. Please note new mailing address as we update.

Rates include state county and city taxes. The City Assessors office maintains a database of Wyomings approximately 25000 real and personal property parcels. Enter your search criteria either last name address or parcel number.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Counties in Wyoming collect an average of 058 of a propertys assesed fair. Streamlined Sales Tax Project.

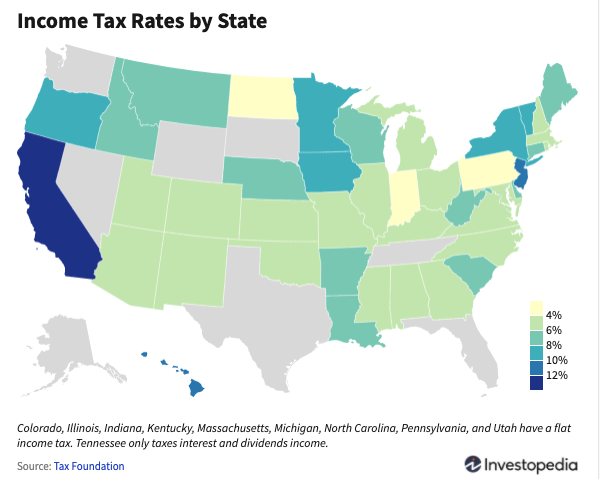

ZIP--ZIP code is required but the 4 is optional. The 2022 state personal income tax brackets. 31 rows The latest sales tax rates for cities in Wyoming WY state.

ZIP--ZIP code is required but the 4 is optional. Depending on local municipalities the total tax rate can be as high as 6. Exemptions to the Wyoming sales tax will vary by state.

Address Lookup for Jurisdictions and Sales Tax Rate. Address Search by Address through Property Building Department Miscellaneous Receivable Tax and Utility Billing Records. Wyoming County Tax Information.

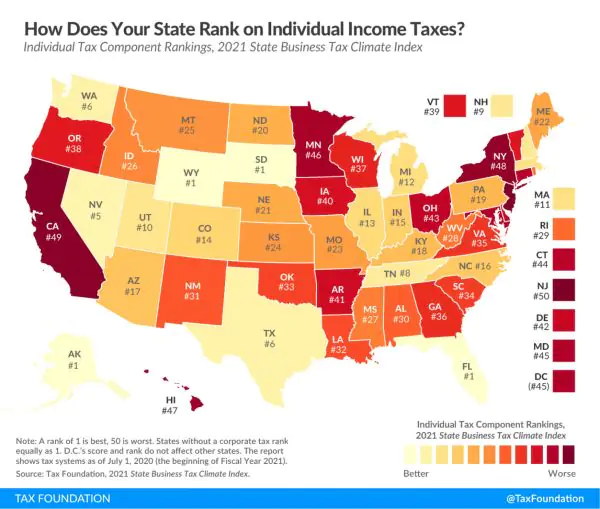

Instructions for Form 1040 Form W-9. Wyomings tax system ranks. Before the official 2022 Wyoming income tax rates are released provisional 2022 tax rates are based on Wyomings 2021 income tax brackets.

Prescription drugs and groceries are exempt from sales. 2020 rates included for use while preparing your income tax. This is the total of state county and city sales tax rates.

The mission of the Property Tax Division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property. Individual Tax Return Form 1040 Instructions. Small Business Events in Your Area.

On the left hand side of the screen click on Tax Information Search. Sales Use Tax Rate Charts. Skip to main content.

Please use the following credentials to enter the system. The minimum combined 2022 sales tax rate for Cheyenne Wyoming is. To access the tax information system please click here.

Qod Updated How Many States Do Not Have State Income Taxes Blog

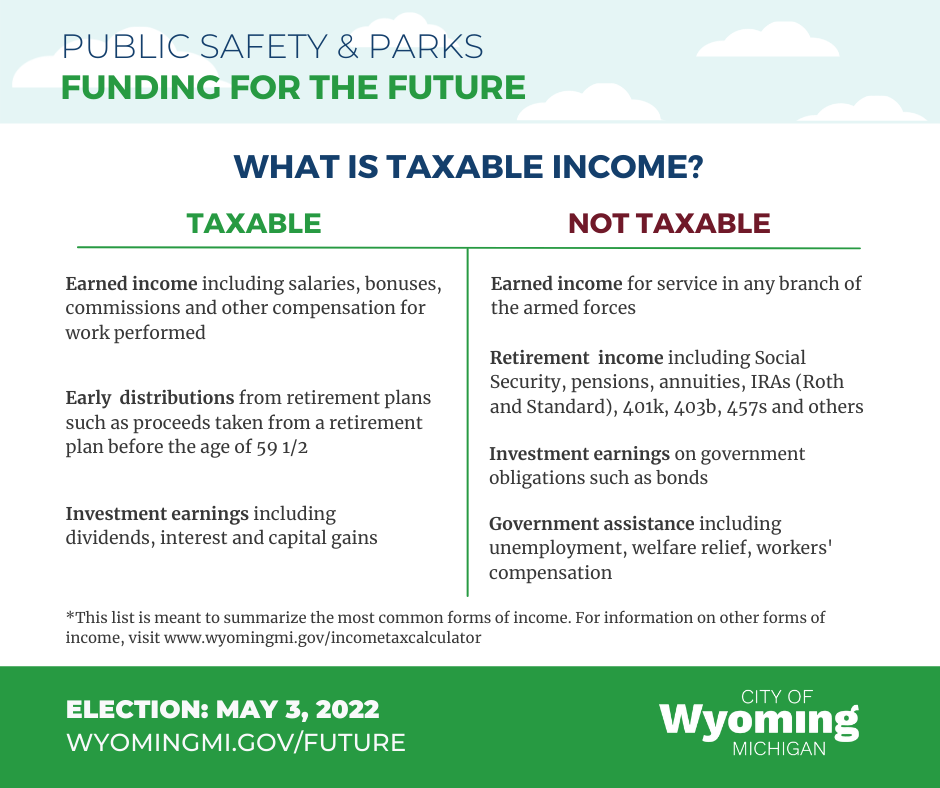

Wyoming Public Schools Planning For The Future

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Wyoming Sales Tax Calculator Reverse Sales Dremployee

How To Form An Llc In Wyoming 2022 Guide Forbes Advisor

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

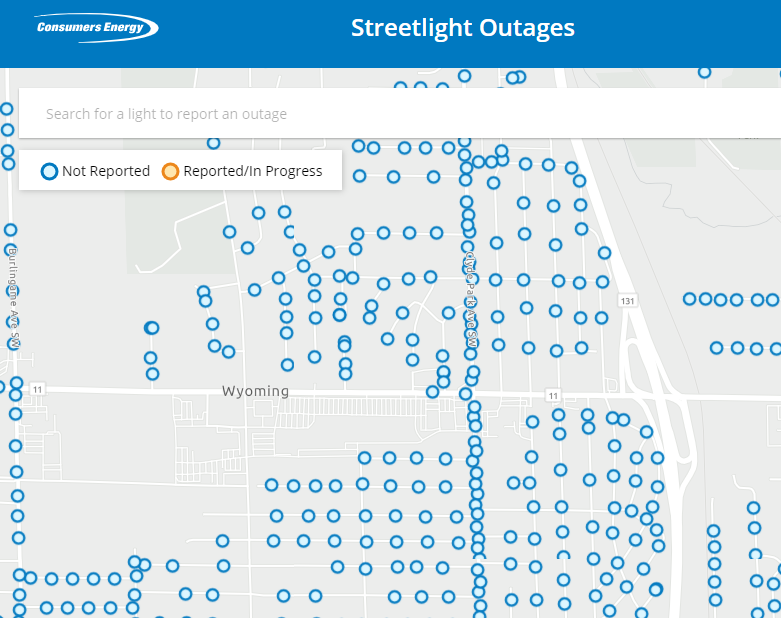

City Of Wyoming About Wyoming City Departments Public Works Traffic

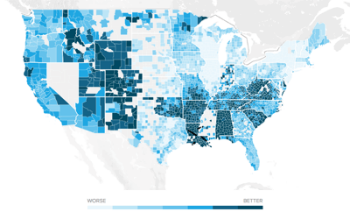

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Property Tax Calculator Smartasset

State Lodging Tax Requirements

Crook County Wyoming Sales Tax Calculator 2022 Investomatica

Sales Taxes In The United States Wikipedia